LifeHack - Insurance

LifeHack - Insurance

ref:

- https://zhuanlan.zhihu.com/p/596414061

Life and Accident Insurance

- HSA: 3100

- FSA: 3050 / 610

- LP FSA: 3050 / 610

- Dependent Day Care FSA: 5000

| Account Type | Annual Limit + Carryover | Eligible Expenses | Tax Advantage |

|---|---|---|---|

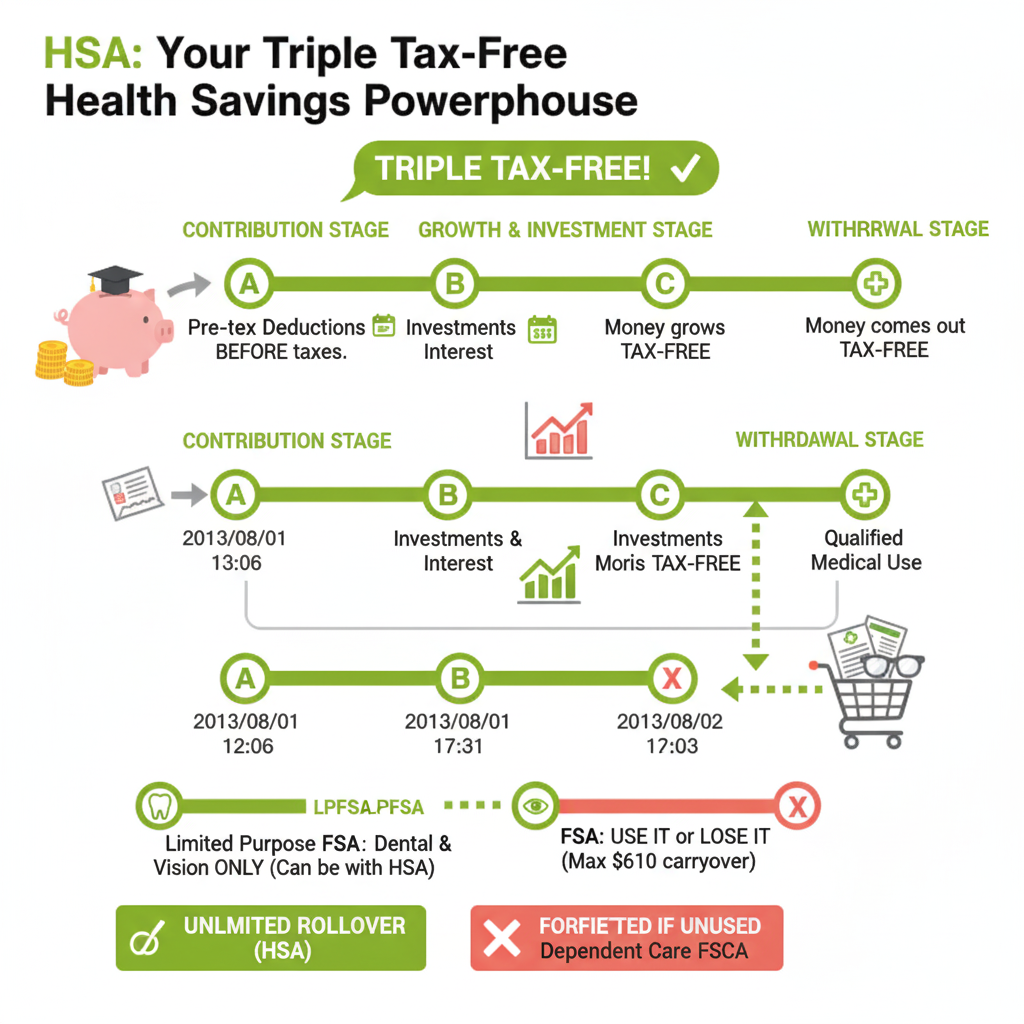

| HSA | ✅ Unlimited rollover | Medical, dental, vision | Triple tax-free (contribution, growth, withdrawal) |

| FSA | ✅ max carryover | Medical, dental, vision | Tax-free contribution |

| LPFSA | ✅ max carryover | Vision, dental only | Tax-free contribution |

| Dependent Care FSA | ❌ Forfeited if unused | Childcare / elder care | Tax-free contribution |

Note:

- 可以同时有 hsa 和 lpfsa,后者报销 vision 和 dental

| Account Type | 2026 | 2025 |

|---|---|---|

| HSA | $4400 ($750) | $4300($750) |

| FSA | $3400 ($680 carryover) | $3300 ($660 carryover) |

| LPFSA | $3400 ($680 carryover) | $3300 ($660 carryover) |

| Dependent Care FSA | $5000 Forfeited | $5000 Forfeited |

📊 Summary

1

2

3

4

5

6

(1056 + 288)*0.35 = 470+

# 放满,每年避税1000+

(2300 + 610)*0.35 = 1,018.4999999999999

(4300 + 3300)*0.35 = 2,660

(4400 + 3400)*0.35 = 2,730

HSA

- Fruit Contribution: 750 one time, 750

- Your annual contribution:

~$88/paycheck (~$2,300/year)~$115/paycheck x 26 ($2,990/year)

LPFSA

- Your annual contribution:

$24/paycheck x 26 (~$624/year)$11/paycheck x 26 (~$286/year)

💰 HSA

Health Savings Account:

- save before-tax money

- pay for eligible

medical, dental, and vision expenses, like coinsurance, copays, and more. - Grows tax-free when invested (balance ≥ $2,100).

- At the end of the calendar year,

any unused money rolls over. - If you leave or retire, take the account with you, and use the money to pay for Medicare and other health expenses in retirement.

- In several states, HSA contributions do not reduce taxable income for state income tax purposes

🦷 LPFSA (LTD Purpose FSA)

Limited Purpose Health Care Flexible Spending Account:

- save before-tax money

- If you’re enrolled in HSA, you aren’t eligible for the traditional FSA, but participate in a LPFSA.

- This account works the same way except that you can only use it for certain dental and vision expenses

- you can’t use a LPFSA to pay for any medical expenses.

- Annual limit:

$3,050with$610carryover - Unused balance beyond carryover is forfeited

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

What expenses are eligible?

Qualified out-of-pocket expenses for dental or vision care provided to you, the spouse or dependents.

Typical eligible expenses include:

Dental:

• Artificial teeth

• Braces

• Dental plan deductible, coinsurance and copayments

• Dental services like exams, cleanings, fillings and X-rays

• Mouth guards

• Orthodontia services

• Tooth removals

Vision:

• Contact lenses and solutions

• Eyeglasses and frames

• LASIK eye surgery

• Vision exams

• Vision plan deductible, coinsurance and copayments

💼 FSA

Health Care Flexible Spending Account:

- save before-tax money

- use for eligible

medical, dental, and vision expenses like copays, coinsurance, and more. - At the end of the calendar year, up to

$610of unused contributions will carry over to the following year as long as you re-enroll in a FSA; otherwise, it will be forfeited. - When you enroll in this account, you can contribute from

$100 to $3050each year. The contribution limit may be adjusted annually by the IRS.

👶 Dependent Day Care FSA

Dependent Day Care Flexible Spending Account:

- save before-tax money to use for

eligible dependent child care or elder care expensesso that you (or you and the spouse, if you’re married) can work. - Highly compensated employees may have their Dependent Day Care FSA annual contributions reduced in order for the plan to satisfy IRS requirements.

- If the spouse’s or partner’s employer has a Dependent Day Care FSA where the contributions typically are not reduced below

$5,000, then consider if that plan is a better option for the family. - You will be notified prior to any reduction. At the end of the calendar year, any unused contributions will be forfeited. For a list of eligible and ineligible expenses

- You can’t use this account to get reimbursed for the dependents’ health care expenses.

Women’s Health

- Women’s Health: A Chinese Medicine Perspective

Mental Health

- Employee Assistance Program (EAP)

Lyra

Enhanced 1-on-1 support. Receive up to 25 coaching and/or counseling sessions per person each calendar year, for you and your eligible family members, to get the care and support you need.

ComPsych / AbleTo (old)

- It offers short-term counseling, guidance, and referrals on financial, legal, and work-life topics to help you navigate life’s ins and outs

Life happens

- Some mental health or substance abuse issues might go beyond the scope of EAP. For these cases, a counselor will refer you to your medical plan for mental health or chemical dependency services or to local community support.

Financial Coaching

unlimited phone consultations with ComPsych staff financial experts. You can seek support for a number of topics including retirement planning, relocation, budgeting, debt management, and more.

need additional support, ComPsych offers two 30-minute consultations by phone or in-person per issue during a 12-month period. ComPsych will refer you to a local financial expert.

Legal Resources

- unlimited phone consultations with ComPsych staff attorneys.

- need additional support, such as representation or document preparation, get one 30-minute consultation by phone or in person, per issue in a 12-month period. You’ll be referred to a local ComPsych network attorney who specializes in the area in which you need help. And if you hire an attorney referred by ComPsych, you’ll get a 25 percent discount on their hourly rate.

Comments powered by Disqus.