Company Benefit

Company Benefit

- Company Benefit

ref:

- https://zhuanlan.zhihu.com/p/596414061

Future Plan

Overview

3 kinds of 401k: Traditional, Roth, After-Tax

- Pre-tax / Traditional 401k:

198/pay- pre-tax contribution

- 拿出时候

contribution和growth都交税 - lowers the taxable income for the current year

- 提前拿出的话 tax+10% penalty

- After-tax 401k:

- after-tax contribution

- 拿出时候

contribution不交税,growth交税, pay taxes on growth upon withdrawal - 提前拿出的话 tax+10% penalty

- Traditional IRA:

- pre-tax contribution

- 类似 Pre-tax 401k

- 如果夫妻都没有 401k,就可以自己存钱进 IRA

- 报税的时候可以降低应税收入

- Roth 401k:

198/pay(2nd best)- after-tax contribution

- 拿出

contribution和growth都不交税- 提前拿出的话 tax+10% penalty

- Roth IRA:(1st best)

- after-tax contribution 或者 mega backdoor conversion

- 拿出

contribution和growth都不交税- 提前拿出 contribution 没有 penalty

- 每年最多放

$6500 - 高收入者不允许存 Roth IRA

- 但是高收入者可以通过 Backdoor Rollover 来绕开这个限制,而且也完全合法。

- 在 Fidelity 网站上操作,先开一个 Traditional IRA,再开 Roth IRA,然后把银行的税后钱

$6500存到 Traditional IRA,等到账了,立即 Rollover 到 Roth IRA。 - 在网站上就是直接用 Transfer,而没有 Rollover 字眼,其实就是账户间转账。因为你存入 Traditional IRA 的钱是税后的,所以没有税务问题。

- Roth 401k vs Roth IRA

- 这两个账户没什么本质区别,除了 Roth IRA 可以本金随时取出之外这点好处。

- 其他的差别有:

- 401k 账户里的 low cost mutual fund (比如 vanguard 提供了些很好的,所以说尽量别选取些 high expense ratio 的 mutual fund,每年 1%的 cost adds up 非常巨大), Roth 401k 可以享受到

- IRA 账户的投资选择非常自由(mutual fund,ETF,crypto,投资煎饼果子铺,以及各种别的投机倒把),你在外部 brokerage 能做的 IRA 基本都能做。

pay

- Your first

$23,000+ company Match goes into 1 or 2. - Everything above goes into After-Tax.

- The key is:

- You are not allowed to contribute amounts over

$23,000to Roth. - But you are allowed to convert amounts over

$23,000from After-Tax to Roth.

- You are not allowed to contribute amounts over

401k

401k 的钱必须从 paycheck 里来

401k can be traditional or roth, and they share a limit.

After-tax 401k is a separate thing, often called mega backdoor roth

Contribution types

choose to make the regular, catch-up, and commission contributions as Traditional 401(k), Roth 401(k), or both.

Pre-tax / Traditional 401(k)

- contributions are made before-tax (

Pre-tax Deductions) - Part of the paycheck goes in to the 401(k) account before the taxable income is calculated (other than Social Security).

- This lowers the taxable income for the current year.

- When you

withdraw the money later, you pay taxeson the contributions and related earnings.

- contributions are made before-tax (

Roth 401(k)

- contributions are made after-tax (

Post-Tax Deductions) - Part of the paycheck goes in to the account after it’s taxed as income.

- So when you

withdraw this money later, you won’t need to pay taxes or penalties(if you meet all requirements and conditions).

- contributions are made after-tax (

After-tax 401k

- 税后的钱干嘛往 Post-tax 养老账号存呢,自己留着花不行吗,反正也要交利得税。

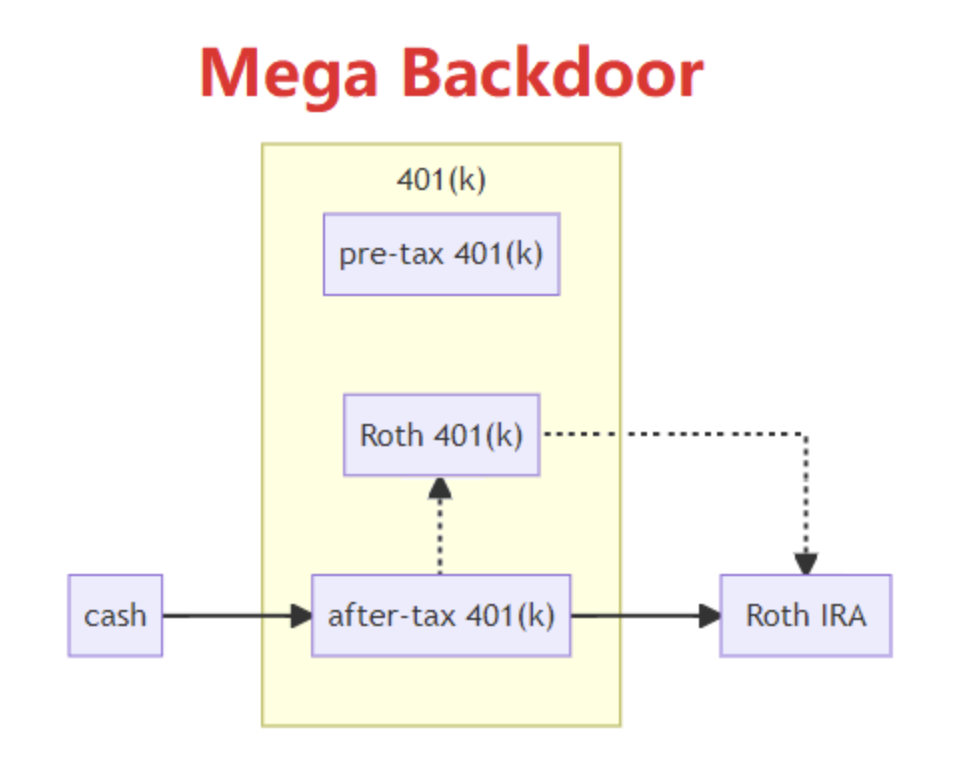

- 这里就要提所谓的 Mega Backdoor Rollover: 把 Post-tax 401k 里付过税的 Contribution 存到 Roth 401k 或者 个人的 Roth IRA,这样利得也不用交税了。

contribution limit

- 401(k)每年存入总额的 annual addition limit (415(c) limit)

- elective deferral limit (402(g) limit)。

- 前者总是比后者大,差值部分可以构成一个叫 after-tax 401(k)的子账户。

- 1986 年国会在 Revenue Act 中正式定义 401(k)的 elective deferral,这之后才有今日意义上的 after-tax 401(k)。

- After-tax 401(k)的税务规则类似于高收入人士的 traditional IRA,存入税后收入,取出时盈利部分还要再缴收入税,因此其本身并非省税利器。

- 但正如高收入人士的 traditional IRA 是 backdoor Roth 的中转工具,after-tax 401(k)是一种叫 mega backdoor Roth 操作的中转工具。

- 相比 backdoor Roth 每年数千的额度,mega backdoor 通常每年可以增加数万的 Roth 存入限额,不愧 mega 之名。

Loans:

- If you have a balance of

$2000or more in the 401(k) Plan, you could be eligible to take out a loan against the funds in the 401(k) account. You’ll then repay this loan into the account using after-tax deductions from the paycheck. take out two types of loans:- A general-purpose loan (for any reason)

- A residential loan (to help you buy a primary home)

Withdrawals:

- withdraw all or part of the balance in the 401(k) Plan account for the reasons below.

- You have direct rollover contributions

- You have After-tax contributions

- You encounter financial hardship as defined by the IRS

- You’re a qualified reservist called to active military service

- You’re divorced and receive a Qualified Domestic Relations Order

- You become permanently disabled and qualify for Long-Term Disability benefits

- You

reach age 59 - Your employment ends

- You reach the minimum required distribution (MRD) age

- You pass away

前雇主遗留下来的 401k 账号

- 所有的操作,最终的目标都是把钱往 Roth 转,因为 Roth 的资本利得是不用交税的。

- 如果通胀率比利率高很多的话,那么标普 500 还是会涨的。

- 比如纸币贬值到一半时,如果不考虑利率的话,股市应该涨一倍,因为股权和地产一样,是生息资产。但是这样涨的一倍是要交资本利得税的,我觉得这非常不合理,这不是资本利得,这只是抗了通胀而已,资产购买力根本没有增值。房价因为通胀的上涨也类似。通胀就是收割工具,以税收的名义。

当然通胀对债权人收割得更厉害,我的理解是,通胀是伴随着民主制度产生的;王权时代是不欢迎通胀的,高阶层应该喜欢通缩,虽然经济发展会受影响,但可以固化阶级地位;民主制度下的福利政府制造了通胀,因为放贷阶级对货币与财政政策的影响力小了。政府需要大财政预算,发展了经济,导致了通胀,并间接增加了税收。对个人而言,持有现金永远是错的。

- 扯远了。前雇主的 401k 放着不动没问题,它会是一个独立的账号,存着 S&P500 不管就可以了,与 IRA 和现雇主 401k 都无关。但是如果哪一年你的总收入太低的话,可以打电话给 Fidelity 要求部分或者全部转到 Roth IRA,比如转

$30000,那么你的当年收入就多$30000。根据 “Married Filing Jointly” Tax Bracket,$340000是个坎,过了就是 32%,之前是 24%,你得让这$30000拿到一个低税率,否则没必要转去 Roth。把这种账号当税率调节器就好了。

IRA

IRA 全称 Individual Retirement Arrangement,一开始是给那些没有 401k 计划的人用来自己存养老金的,分 Traditional IRA 和 Roth IRA.

Traditional IRA: 税前账号

- 类似 Pre-tax 401k。

- 如果夫妻都没有 401k,就可以自己存钱进 IRA,报税的时候可以降低应税收入。

Roth IRA:

- 和 Roth 401k 一样是存入税后的资金,资本利得也不用交税。

- 因为太强大,所以 IRS 除了每年

$6500的限制,还设置了收入上限,高收入者不允许存 Roth IRA。 - 但是高收入者可以通过 Backdoor Rollover 来绕开这个限制,而且也完全合法。

Backdoor Rollover:

- 在 Fidelity 网站上操作,先开一个

Traditional IRA,再开Roth IRA - 把银行的税后钱

$6500存到Traditional IRA,等到账了,立即 Rollover 到Roth IRA - 在网站上就是直接用 Transfer,而没有 Rollover 字眼,其实就是账户间转账。

因为你存入 Traditional IRA 的钱是税后的,所以没有税务问题。

- 前面说到 Traditional IRA 是税前账号,为什么可以存税后的钱呢

- 其实 Traditional IRA 挺复杂的,里面可以同时存在

Pre-tax 和 Post-tax资金 - 比如,如果你没有及时把存入的

$6500转出,结果基金赚了$6500,那么这$6500是要交税的。 - 这个时候你再转

$6500去 Roth IRA,你就不能说这$6500是交过税的,而是要根据 Pro-rata 准则按比例交税,也就是说这钱有一半交过税,一半没交过。具体请去 Google Pro-rata,如果有多个 Traditional IRA 账号更麻烦,要算总账。 - 所以最好就是不要让 Traditional IRA 出现 Pre-tax balance,每次 Rollover 操作都把 Traditional IRA 清零就最简单,该交税的部分交税,然后从零开始做

$6500Rollover。 - 注意,这种 Backdoor Rollover 好像有个 5 年不可取出的限制,但不用等退休。

- 其实 Traditional IRA 挺复杂的,里面可以同时存在

Mega Backdoor Roth - MBDR

做 mega backdoor 的先决条件是

- 401(k) plan 提供 after-tax 401(k)选项

- After-tax 401(k)

- After-tax 401(k)支持 in-service distribution(在职期间可取)

- (或者) 401(k) plan 提供 after-tax 401(k) –> Roth 401(k)的 in-plan Roth rollover

convert from a tax-deferred status in 401(k) –> to a Roth position that allows to pull out the contributions and growth tax free the conversions are from After-Tax 401(k) -> Roth IRA

post-tax / roth conversions can be done automatically if the plan offers’ it (Fidelity does): a. Using Roth IRA: be limited to the Roth IRA contribution limits of $7k b. Using Roth 401(k): There is no need for a conversion and no Roth IRA limits.

Considering the strategy makes use of 401(k) contribution limits:

- Pre-tax 401(k) contributions

- pulled from the paycheck

$23k2024 limit

Post-tax

$69k2024 limit:$23k- Employer MatchRemaining amount left as an option to auto-contribute from our paycheck

- there is only a

$7klimit for regular backdoor roth conversion (traditional IRA -> Roth IRA), and this limit does not apply for 401(k) roth conversions?

0 relationship between the 401(k) contributions (and their limits) and the IRA contributions (and their limits).

- the only advantage I can think of is that gains aren’t realized and taxed until you withdraw with the 401k. So you can reinvest full dividends and so on without tax burden until you pull the money out decades later. I suspect for most people you’d come out ahead paying long term capital gains on the brokerage vs income tax on the 401k withdrawals, but I’m sure there are some people that can benefit

Summary

- 401k 的 contribution Limit:

Pre-tax + Roth 401k <= $22500 - 所有的 Contribution Limit:

Pre-tax + Roth 401k + Post-tax + Employer Match <= $66000

小计算:

假设公司 match 你 50%的 contribution,也就送你的 free money

$9750你还可以每年放

$57,000 – $19,500 – $9750 = $27,750的税后 contribution。Pre-tax / Traditional 401k 最差因为它的本金投资都要交税,还不让 59.5 岁前提前取出本金,用它还不如用一个朴朴素素的 Robinhood,

最好的是 Roth IRA,投资收益不交税,本金还随时取出。复利的意义在于用当年的投资收益来做下一年的投资,而且在最后拿出来的收益都不收税. 可是 IRS 不是傻子,一年只让人放

$6000推荐Roth 401k, 用复利来盈利,所以 low cost fund 会非常有优势,而且未来任何时候都可以把 Roth 401k 的全部本金和收益转进 Roth IRA, penalty free。

Mega backdoor就是一个能让我们把

$27,750的 After-Tax 401k 转成 Roth IRA 的走后门方法。从 After-tax 401k 转成

Roth 401k 或者 Roth IRA因为 401k 是公司 sponsor,所以并不是每家公司都可以允许你放 after-tax 401k 进而用 Mega Backdoor Conversion。如果公司允许的话,你可以自己

手动选择从after-tax 401k里的钱转成Roth IRA,或者自动转成Roth 401k。当转进 IRA 的时候是属于 withdraw,收益部分会有 tax,所以

需要钱一到401k就及时转,或者索性设置自动转成 Roth 401k。

既然 after-tax 这么好,为什么还要存 pre-tax 401k ?

上面讲到过公司 match 你个人的

$19,500IRS limit 401k contribution,不管你是放 pretax 401k,还是税后的 Roth 401k。放 pretax 的好处是你不交税,用原本该交税的那部分钱去为你投资赚钱,但是最后的收益是要交税。

after-tax 是你损失了一部分 tax,而用更昂贵的 after-tax money 来为你赚钱,奖励是最后收益不交钱。

具体用哪个其实很复杂,取决与你现在的收入高低,未来期望收入变化,tax bracket 高低,以及美国税法将来改变的可能性,因为太复杂所以不细说了,但大家公认的是先放满 pretax 401k 先 defer 一点 tax 再说.

操作

- Fidelity 网站上无法操作这种 Mega backdoor,必须打电话 800-835-5095。这个号码是 Workplace 部门,也就是管理 401k 的部门。401k 和 IRA 在 Fidelity 内部是两套人马,甚至是两套系统,401k 的 online 自助系统叫 Netbeans。

- 打电话的时候可以要求把现有账号 Balance 交过税的部分转到

Roth 401k,或者个人的Roth IRA,把利得部分也就是没有交过税的部分转到Traditional IRA,这种操作叫 Split Rollover。 - 我自己只转了 Post-tax 部分,因为我希望我的

Traditional IRA保持为$0余额,原因见后面的 (IRA) Backdoor Rollover 介绍。这样的转账 (rollover) 每年是没有限额的,怎么转都行,因为不用补税,也不是不养老取出来花了,所以 IRS 不会为难你。 - IRS 限制的是每年的 Contribution Limit,比如

Traditional IRA一年只能存入$6500,那么你完全可以今年存$6500,明年存$6500,但是后年 rollover$13000到 Roth IRA。 - 为了避免老是要打电话,你还可以要求 Fidelity 在每一个 Paycheck 的时点自动地把 Post-tax contribution rollover 至 Roth 401k。这种操作称作 in-plan rollover,很多账号支持这个操作。这种自动操作只能转至 Roth 401k,而不能转至 Roth IRA。

综上,Roth 是个好东西,每年应该尽可能放满。当然,也不能 Pre-tax 账号就不存钱。只要让退休取钱时,能拿到一个好的税率就行,按这个标准不但应该存,而且应该存不少。我目前的 $22500 limit 全部存 Pre-tax,不存 Roth。

- 关于投资策略,我几乎全仓 Fidelity 500 Index Fund,最多遇到真正的经济危机时,短暂转 Money Market Fund。仅供参考。这个 Index Fund 只有 0.015% 的费率,相比而言,Target Date Funds 的 0.5% 费率简直就是 Scam。

总结操作:

- 放满

Pre-tax 401k,让Employer Match也存满,不存 Roth 401k。 - 再放满

Post-tax 401k,打电话要求 Fidelity 做自动 In-plan Rollover,即 Mega Backdoor;现有 Post-tax Balance 的 after tax 部分转去 Roth 401k。 - 每年存满 Traditional IRA,再存满 Spouse Traditional IRA,到账后立即 Backdoor Rollover (Online Transfer) 至 Roth IRA。

Company

If you make After-tax or catch-up contributions (optional if you’re 50 or older), these aren’t matched by Company

The maximum you’ll get is 50% of 6% of the base salary, irrespective of whether you put it in traditional or Roth or a mix of both. So in the example above, Company’s contribution will not exceed

$3000.Contribution types

- You can choose to make the regular, catch-up, and commission contributions as Traditional 401(k), Roth 401(k), or both.

Contribution sources and amounts

- Depending on the situation, here’s what you can contribute to the Company 401(k) Plan in Traditional 401(k), Roth 401(k), or a combination of both contribution types:

- You can contribute 1 percent to 75 percent of the eligible regular pay.

- If you’re 50 or older, you can also make additional catch-up contributions of 1 percent to 75 percent of the eligible pay. These contributions aren’t eligible for Company Match, and you’ll need to make a separate contribution election for catch-up.

- If you receive sales commissions as part of the eligible pay and want to contribute a portion of the commissions, you’ll need to designate a separate contribution rate, from 1 percent to 75 percent, for the commission pay.

After-tax contributions

- To save more than the annual 401(k) contribution limit for the year, you can make After-tax contributions.

- You can contribute 1 to 20 percent of the eligible pay in After-tax contributions, up to the IRS annual additions limit.

- Note that Company doesn’t match After-tax contributions. So before you make them, you might want to make regular contributions of at least 6 percent. This helps you get all of the eligible Company Match.

- However, if you choose an after-tax rate that’s too high, you might reach the annual additions limit before the end of the year and may not maximize the

regular contributions and the Company Match.

Roth 401(k) contributions

- You can convert the

before-tax,non-Roth After-taxcontributions andearningstoRoth 401(k)contributions. If you qualify for a tax-free qualified distribution as defined by the IRS, earnings on Roth 401(k) contributions will not be taxed.

- You can convert the

Company Match

- When you contribute to the Company 401(k) Plan, Company matches the contributions — up to 6 percent of the eligible pay each pay period.

- Your Company Match is immediately vested, meaning that all matching funds are these as soon as they’re deposited into the 401(k) account. This match doesn’t count toward the IRS annual contribution limit. And these funds aren’t taxable until you withdraw them.

- If you make

After-taxor catch-up contributions (optional if you’re 50 or older), these aren’t matched by Company. - The amount of the Company Match for which you’re eligible depends on the years of service with Company as of the pay date. If you leave and are rehired by Company within two years, the Company Match rate might depend on the rehire date (or an adjusted hire date).

| If you’ve been at Company for… | Company matches you at… |

|---|---|

| Less than x years | 50 percent: Company contributes 50 cents for every dollar you contribute. |

| x years or more but less than x years | 75 percent: Company contributes 75 cents for every dollar you contribute. |

| x years or more | 100 percent: Company matches the contribution dollar for dollar. |

Maximize the match

- The Company Match is calculated and put into the account each pay period.

To get the maximum Company Match, contribute

at least 6 percentof the biweekly pay (and 6 percent of the commission pay, if applicable) each pay period. If you choose to contribute more than this, you could reach the annual IRS contribution limit too early in the year. Then you miss out on any Company Match you could have gotten by contributing through the whole year.To get the maximum Company Match: Fidelity’s Contribution Maximizer tool

- Use the Contribution Maximizer tool, if you’d like to contribute to the IRS Section 402(g) limit or Section 415 limit and maximize the Company Match.

- The Contribution Maximizer proposes contribution rates that will help you maximize both the contributions and Company Match up to the IRS annual limit by contributing at or above 6 percent for regular contributions on each paycheck throughout the year.

Maximizer rates are determined by dividing the remaining 401(k) contributions allowed by the remaining estimated plan-eligible compensation for the current calendar year.

Select from the following options to see how using Maximizer rates can impact the overall savings.

Each Maximizer rate is a proposed contribution rate that will help you maximize the various contributions and Company Match up to the applicable IRS limits. It is determined by dividing each of the remaining contribution types allowed by the remaining estimated plan eligible compensation for the current calendar year.

Maximize regular contributions:

- This refers to the

IRS Section 402(g) limiton theregular 401(k) contributions you can make to the Plan account in a calendar year. - For 2024, that limit is

$23,000. - Select this option to adjust the contributions to reach this limit while maximizing the Company Match.

- The regular Maximizer rate will always be at or above 6% on each pay check in order to maximize the per pay check Company Match.

- This refers to the

Maximize total contributions:

- This refers to the

IRS Section 415 limiton thetotal contributions both you and Company can make to the Plan account in a calendar year. - For 2024, that limit is

$69,000. - Select this option to adjust the contributions to reach this limit while maximizing the Company Match.

- This refers to the

Based on the estimated plan eligible compensation and Company 401(k) Plan limits, if you select to

maximize the regular contributions or maximize total contributions, the resulting contribution amount may not reach the IRS limit. You can contribute up to the Plan limits, which allow contributions of up to 75% of eligible base pay in Traditional Base Pay 401(k) and Roth 401(k) contributions, and up to 20% of eligible base pay in After-Tax contributions.You can transfer from in-plant Roth to a Roth IRA 4 times in a year. You can do this at the end of every quarter or whatever works for you

When I called Fidelity to help me open Roth IRA they mentioned a salary limit. You can do a rollover and open a Roth IRA with it. Salary limit is for direct contribution to Roth IRA. link

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

69,000 - 23,000 - 7,746.44 = 38,253.56

Maximum total Plan contributions allowed for calendar year $69,000.00

Maximum Regular allowed for calendar year $23,000.00

Projected Regular contributions for calendar year $23,000.00

Projected Company Match for calendar year $ 7,746.44

Regular Maximizer rate 15.57%

Estimated Regular for next pay date $ 397.26

Estimated bi-weekly Regular contribution $ 1,030.88

Regular year-to-date $ 1,986.30

Remaining Regular for calendar year $20,616.44

Estimated Company Match for next pay date $ 297.94

Estimated bi-weekly Company Match contribution $ 595.88

Company Match year-to-date $ 1,489.70

Estimated Company Match remaining for calendar year $ 5,958.80

Estimated Company Match for calendar year $ 7,746.44

---

Estimated After-Tax allowed for calendar year $26,483.60

After-Tax contributions (up to 20.00%)

After-Tax Maximizer rate 20.00%

Estimated After-Tax for next pay date $ 0.00

Estimated bi-weekly After-Tax contribution $ 1,324.18

Remaining After-Tax for calendar year $26,483.60

Leave

Personal Medical Leaves

Sick Pay

If you’re unable to perform the duties of your job because of mental or physical illness or injury, you can take sick days to recover. Sick pay even covers time away for medical appointments.

- Sick pay continues your pay if you’re unable to work. You can earn up to 240 hours (30 days) to care for yourself or your family members.

- If you miss more than seven consecutive calendar days of work, you must apply for a leave of absence.

Use sick time:

What you can use it for: Depending on your work location, you might be able to use regional sick leave for your own health, your family’s health, public health issues, and personal safety. Regional sick leave and Company sick pay both appear on your timecard and payslip as sick, regardless of the specific reason for taking this time away.

- Take care of yourself when you’re sick or injured, physically or mentally

- Care for ill or injured family members

Attend medical appointmentsfor yourself or a family member- Receive part of your pay while you’re on certain leaves, like pregnancy and short-term disability, and other paid or unpaid state and federal leaves (referred to as supplemental leave pay)

Take up to seven calendar days at a time. Sick pay starts on the first day you’re away to care for yourself or a family member. You can miss up to seven consecutive calendar days and receive sick pay for any scheduled work days during that time — or until you use all your sick hours, whichever comes first.

Other things to know

- If you get regional sick leave, you must use your regional sick leave before you use Company sick pay.

- When you take a sick day, you can only use the earned time that’s available in your sick pay balance in Workday as of the date of your time away from work. If you don’t have enough time in your sick pay balance to cover your time away, you may use vacation time to make up the difference or use vacation time instead of sick pay.

- You must use any available sick pay before requesting unpaid time away.

- If you’re a commissioned employee, sick pay covers only your base salary.

- If you leave Company, you forfeit any unused sick pay.

regional sick leave

Some cities and states have passed paid sick leave legislation that Company refers to as regional sick leave. This sick leave is available to full-time employees, part-time employees, and fixed-term employees who work in certain locations (details below).

Depending on where you work, you might earn 40 to 80 hours of sick leave according to local laws. If both your city and state have sick leave laws, you get whichever benefit is more generous.

Regional sick leave will be coordinated with your Company sick pay (if you’re eligible). If you work in a region where the Company sick pay policy meets (or is more generous than) the regional law, you’ll receive Company sick pay only, which you can use for any eligible reason.

Earning sick pay

- From the first day you begin work at Company, you start earning sick pay — up to a maximum of 240 hours.

- Any sick pay you don’t use rolls over into the next year, up to the maximum.

- If you reach the maximum, you stop earning sick pay until you lower your balance. You also stop earning sick pay during leaves.

For corporate employees

- You earn sick time based on your standard weekly hours in Company’s People information system — up to 12 days per year for full-time employees and six days per year for part-time employees.

Medical Leave

request a medical leave of absence when you’re unable to perform one or more essential functions of your job because you have a serious health condition. Depending on your eligibility, a medical leave may be taken continuously or on an intermittent basis. Sedgwick, Company’s leave and disability administrator, handles medical leaves and determines your eligibility for a medical leave.

Medical leave is unpaid, but you may be eligible for disability benefits during your leave. Sedgwick determines whether you qualify for disability benefits when you request a leave. If you qualify, disability benefits begin after a seven-day unpaid waiting period, and then pay a percentage of your regular wages while you’re away from work. To learn more, see Short-Term Disability.

Washington Paid Family and Medical Leave

If you work in Washington, you may be eligible for Washington Paid Family and Medical Leave (WA PFML) for up to 12 weeks for your own serious health condition, including pregnancy and postpartum recovery. You may be eligible for an additional two weeks of WA PFML benefits for prenatal care appointments and other serious health conditions prior to childbirth.

You’re eligible for WA PFML if you work in Washington for 820 hours.

Sedgwick doesn’t administer WA PFML benefits, but does administer Company’s leave policies that coordinate with WA PFML benefits. You must contact WA PFML and Sedgwick when you need to take a leave of absence.

Returning to work

- Before you can return to work, you must provide Sedgwick with medical certification that states you’re able to return to work and perform the functions of your position, either with or without restrictions.

Family Leave

Paid Family Leave

Unpaid Family Leave

Requirements for specific leave types:

- You may take a leave to care for a family member with a serious health condition. Family members include your spouse or domestic partner, parent, or child (including an adopted or foster child and your spouse or domestic partner’s child), sibling, grandparent, grandchild, parent-in-law, or designated person.

Parental Leaves

Full-time team members:

Pregnancy Leave

- Allows for up to

12 weeks of paid or unpaid timeunder Company, local, state, or federal leave programs

- Allows for up to

New Parent Leave

- Applies to the time away from work to bond with your newly born or placed child, up to

6 weeks - Can be taken within the first year after the birth, adoption, or placement of your child

- Applies to the time away from work to bond with your newly born or placed child, up to

Gradual Return to Work

- You may return to work half-time at full pay for up to

4 weeksupon your first return to work from paid or unpaid bonding

- You may return to work half-time at full pay for up to

Maximizing your time away

Before starting your gradual return to work, you’ll want to use all available unpaid time under the Family and Medical Leave Act (FMLA), the California Family Rights Act (CFRA), or other state requirements.

Because FMLA, CFRA, and other state leaves run concurrently with Company’s paid new parent leaves, to maximize your time away you would take your leaves in the following order:

- 10-12 weeks of prenatal and postnatal time, immediately followed by

- Six weeks of New Parent Leave, immediately followed by

- Six weeks of unpaid leave, immediately followed by

- Four weeks of gradual return to work

Because you only intend to take paid time for recovering from the birth and bonding with your child, the order of your leaves won’t impact your plan. It may impact remaining unpaid time. You can take your leaves in the following order:

- 10-12 weeks of prenatal and postnatal time

- Six weeks of New Parent Leave

- Four weeks of gradual return to work

- Up to four weeks of remaining unpaid time (can be taken at a later date)

Life and Accident Insurance

- HSA: 3100

- FSA: 3050 / 610

- LP FSA: 3050 / 610

- Dependent Day Care FSA: 5000

Note:

- 可以同时有 hsa 和 lpfsa,后者报销 vision 和 dental

1

2

3

4

5

(1056 + 288)*0.35 = 470+

# 放满,每年避税1000+

(2300 + 610 )*0.35 = 1018.4999999999999

(7930 + 610 )*0.35 = 1977.5

HSA

- Fruit Contribution: 750 one time, 750

- Your annual contribution: 88+ /pay (1056), 2,300

LPFSA

- Your annual contribution: 24+ /pay (288), 610

HSA

Health Savings Account:

- save before-tax money to pay for eligible

medical, dental, and vision expenses, like coinsurance, copays, and more. - If you have an account balance of

$2100or greater, invest the money, and all earnings grow tax-free. - At the end of the calendar year, any unused money rolls over.

- If you leave or retire, take the account with you, and use the money to pay for Medicare and other health expenses in retirement.

- In several states, HSA contributions do not reduce taxable income for state income tax purposes

FSA

Health Care Flexible Spending Account:

- save before-tax money to use for eligible

medical, dental, and vision expenses like copays, coinsurance, and more. - At the end of the calendar year, up to

$610of unused contributions will carry over to the following year as long as you re-enroll in a FSA; otherwise, it will be forfeited. - When you enroll in this account, you can contribute from

$100 to $3050each year. The contribution limit may be adjusted annually by the IRS.

Limited Purpose FSA

Limited Purpose Health Care Flexible Spending Account:

- If you’re enrolled in HSA, you aren’t eligible for the traditional FSA, but participate in a LPFSA.

- This account works the same way except that you can only use it for certain dental and vision expenses

- you can’t use a LPFSA to pay for any medical expenses.

- At the end of the calendar year, up to

$610of unused contributions will carry over to the following year as long as you re-enroll in a LPFSA; otherwise, it will be forfeited.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

What expenses are eligible?

Qualified out-of-pocket expenses for dental or vision care provided to you, the spouse or dependents.

Typical eligible expenses include:

Dental:

• Artificial teeth

• Braces

• Dental plan deductible, coinsurance and copayments

• Dental services like exams, cleanings, fillings and X-rays

• Mouth guards

• Orthodontia services

• Tooth removals

Vision:

• Contact lenses and solutions

• Eyeglasses and frames

• LASIK eye surgery

• Vision exams

• Vision plan deductible, coinsurance and copayments

Dependent Day Care FSA

Dependent Day Care Flexible Spending Account:

- save before-tax money to use for

eligible dependent child care or elder care expensesso that you (or you and the spouse, if you’re married) can work. - Highly compensated employees may have their Dependent Day Care FSA annual contributions reduced in order for the plan to satisfy IRS requirements.

- If the spouse’s or partner’s employer has a Dependent Day Care FSA where the contributions typically are not reduced below

$5,000, then consider if that plan is a better option for the family. - You will be notified prior to any reduction. At the end of the calendar year, any unused contributions will be forfeited. For a list of eligible and ineligible expenses

- You can’t use this account to get reimbursed for the dependents’ health care expenses.

Women’s Health

- Women’s Health: A Chinese Medicine Perspective

Mental Health

- Employee Assistance Program (EAP)

Lyra

Enhanced 1-on-1 support. Receive up to 25 coaching and/or counseling sessions per person each calendar year, for you and your eligible family members, to get the care and support you need.

ComPsych / AbleTo (old)

- It offers short-term counseling, guidance, and referrals on financial, legal, and work-life topics to help you navigate life’s ins and outs

Life happens

- Some mental health or substance abuse issues might go beyond the scope of EAP. For these cases, a counselor will refer you to your medical plan for mental health or chemical dependency services or to local community support.

Financial Coaching

unlimited phone consultations with ComPsych staff financial experts. You can seek support for a number of topics including retirement planning, relocation, budgeting, debt management, and more.

need additional support, ComPsych offers two 30-minute consultations by phone or in-person per issue during a 12-month period. ComPsych will refer you to a local financial expert.

Legal Resources

- unlimited phone consultations with ComPsych staff attorneys.

- need additional support, such as representation or document preparation, get one 30-minute consultation by phone or in person, per issue in a 12-month period. You’ll be referred to a local ComPsych network attorney who specializes in the area in which you need help. And if you hire an attorney referred by ComPsych, you’ll get a 25 percent discount on their hourly rate.

Comments powered by Disqus.